How Offshore Trusts Can Legally Separate You from Your Wealth

How Offshore Trusts Can Legally Separate You from Your Wealth

Blog Article

How an Offshore Trust Fund Can Boost Your Financial Privacy and Safety And Security

If you're looking to boost your financial privacy and protection, an overseas trust can be a viable alternative. By tactically positioning your properties outside neighborhood jurisdictions, you can protect on your own from possible legal hazards and scrutiny.

Comprehending Offshore Trusts: The Essentials

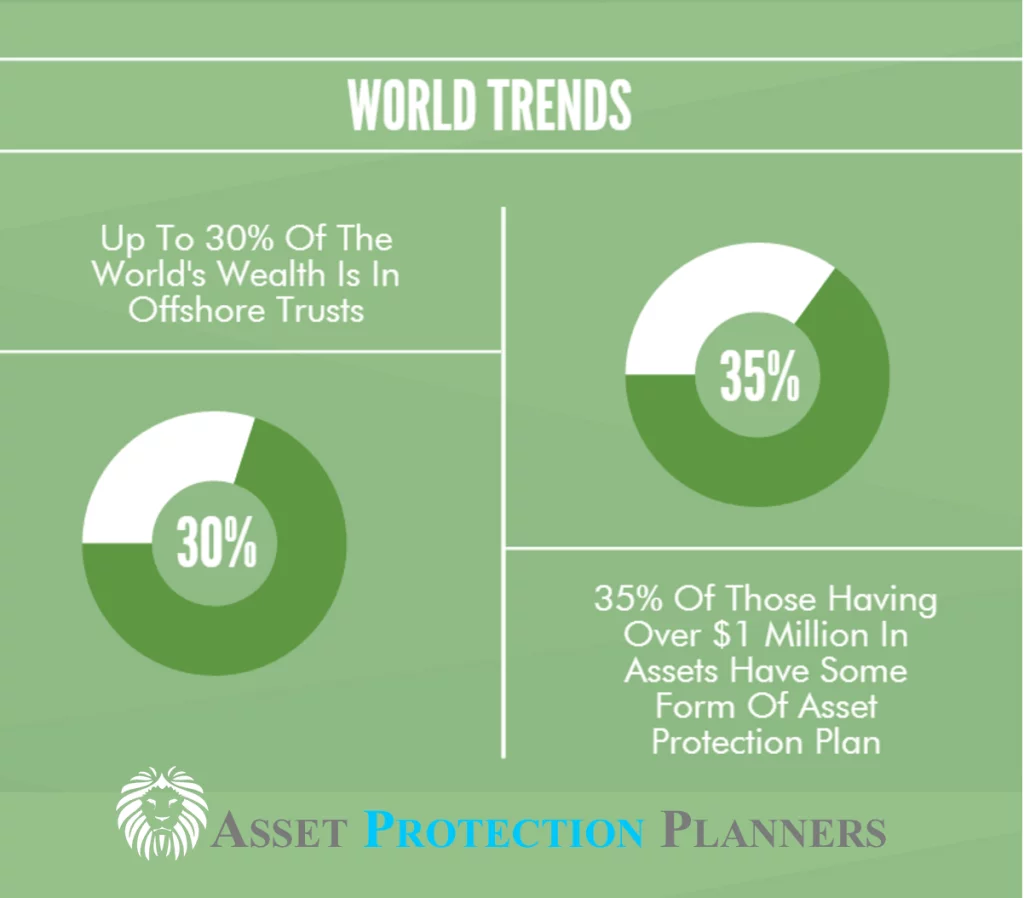

Offshore trusts are powerful financial tools that can provide you with enhanced personal privacy and security for your properties. Essentially, an offshore trust is a lawful plan where you transfer ownership of your possessions to a trustee located outside your home country. This trustee manages the possessions on your part, allowing you to preserve control while delighting in the advantages of overseas monetary systems.

You can use offshore depends on to protect your riches from possible legal problems, tax obligations, or political instability in your home nation. By placing your possessions in an offshore depend on, you produce an obstacle in between your riches and any kind of insurance claims against you, improving your monetary safety and security.

Recognizing the essentials of overseas counts on is crucial for any individual considering this approach. You'll require to choose a trustworthy trustee and navigate the lawful demands of the jurisdiction where the depend on is developed, guaranteeing your properties are safeguarded successfully.

Secret Benefits of Offshore Trust Funds

2nd, offshore trust funds supply diversification. You can purchase numerous money, markets, and asset classes, reducing danger and improving potential returns.

Additionally, they can supply tax benefits. Depending on the jurisdiction, you might take pleasure in tax obligation benefits that boost your total financial method.

Moreover, offshore counts on enable raised control over your riches. You can establish certain terms for how and when your assets are distributed, guaranteeing your intents are recognized.

Last but not least, they can aid with estate preparation. An offshore count on can simplify the transfer of riches across generations, decreasing prospective disputes. Generally, these vital benefits make overseas depends on an enticing choice for monetary security.

Enhancing Financial Personal Privacy With Offshore Trust Funds

When you think about offshore trusts, think of exactly how they can considerably improve your economic privacy. These depends on use robust asset security methods while guaranteeing privacy and privacy in your economic negotiations. By using them, you can secure your wide range from potential threats and keep your personal privacy in a significantly transparent globe.

Property Protection Strategies

Developing an overseas trust fund can be an effective method for improving financial personal privacy and protection, specifically if you're wanting to safeguard your assets from prospective creditors or legal claims. By transferring your possessions into an overseas trust fund, you effectively separate your individual wide range from your lawful identity. This splitting up can deter financial institutions, as they might find it challenging to accessibility assets held in a trust. Furthermore, you can select the territory that uses the best property defense regulations, further safeguarding your financial investments. Regularly assessing and readjusting your count on can assure it continues to be straightened with your monetary objectives, offering long-term protection. Eventually, offshore depends on can be a positive action for any individual looking for to strengthen their economic future.

Confidentiality and Anonymity

Offshore trust funds not only offer robust asset protection however additionally play a significant duty in improving your monetary personal privacy. By placing your assets in an overseas count on, you can efficiently protect your financial information from prying eyes. In enhancement, the trust fund framework can limit access to your economic information, guaranteeing that just licensed individuals have insight right into your properties.

Shielding Assets From Legal Dangers

When it pertains to securing your riches, overseas depends on offer a robust lawful guard against prospective hazards. They give a level of discretion and privacy that can be necessary in shielding your assets. By utilizing reliable possession protection techniques, you can secure your financial future from legal obstacles.

Legal Guard Benefits

While lots of people look for monetary privacy, the legal guard benefits of overseas counts on can use a critical layer of protection versus potential lawful threats. By positioning your assets in an offshore count on, you can produce a barrier that makes it harder for financial institutions or plaintiffs to reach your wealth. This approach helps you guard your possessions from legal actions, divorce negotiations, and various other legal claims. Additionally, the jurisdiction where the depend on is established usually has legislations that favor possession protection, including an extra layer of security. Basically, an offshore trust not only shields your financial interests but additionally enhances your comfort, understanding your wealth is less vulnerable to unpredicted lawful challenges.

Discretion and Privacy

Exactly how can you ensure your monetary events continue to be confidential in today's significantly clear world? An offshore trust fund can supply the confidentiality you look for. By placing your possessions in this trust, you produce a lawful obstacle between your individuality and your riches, effectively securing them from prying eyes. The depend on operates under the legislations of a territory understood for stringent personal privacy laws, making it tough for outsiders to access your details.

In addition, your involvement as a trustee can remain covert, ensuring your name isn't directly linked to the properties. This privacy can hinder potential legal threats, as individuals read review and entities may hesitate before targeting a person whose financial information are covered. Safeguarding your personal privacy has actually never ever been a lot more critical, and an offshore trust is an effective device.

Possession Security Approaches

An overseas depend on not only boosts your monetary personal privacy however also serves as a robust possession protection technique versus legal risks. By placing your assets in a count on located in a territory with strong personal privacy legislations, you can protect them from lenders and legal actions. In today's litigious environment, utilizing an offshore count on can be a wise step to secure your monetary future and maintain control over your properties.

Political and Financial Security: A Consideration

When thinking about overseas depends on, political and economic stability in the picked jurisdiction plays an important function in securing your assets. You desire to ensure that the environment where your count on is developed continues to be safe and trusted. Political turmoil or financial instability can endanger your investments and endanger your economic privacy.

Try to find territories with constant administration, a solid lawful framework, and a background of financial strength. These factors add to the depend on's long life and your assurance.

Furthermore, you ought to assess the country's governing atmosphere. Positive regulations can improve your trust fund's efficiency, while restrictive laws might hinder its performance.

Ultimately, by focusing on political and economic stability, you're not simply protecting your properties; you're additionally leading the way for long-lasting monetary protection. Your mindful choice will certainly aid ensure that your count on remains a powerful device in your monetary strategy, allowing you to attain your goals with self-confidence.

Choosing the Right Territory for Your Offshore Depend On

Which elements should lead your selection of territory for an overseas count on? Look for territories with strong possession defense laws to protect your trust fund from potential creditors.

You ought to likewise consider the governing environment. A reputable territory with clear laws can enhance your count on's integrity and security. Accessibility to expert services is one more vital element; ensure that the jurisdiction has skilled lawful and financial professionals who can assist you efficiently.

Finally, evaluate the confidentiality laws. You want a place that prioritizes your privacy and safeguards your information. By weighing these aspects, you'll be much better furnished to choose a jurisdiction that straightens with your economic objectives and boosts your safety and personal privacy.

Actions to Developing an Offshore Count On

Choosing the appropriate territory is just the beginning of your trip to developing an overseas trust fund. Next, seek advice from a qualified attorney who specializes in offshore trust funds. They'll guide you through the legal needs and guarantee conformity with both neighborhood and worldwide legislations.

Afterwards, identify the assets you want to place in the count on. This might include cash, realty, or investments - Offshore Trusts. When you've established this, select a trustee, a person you rely on or a specialist depend on business, to handle your trust fund top article according to your desires

Then, draft the trust action, laying out the terms and problems. This paper will certainly information how the possessions are taken care of and distributed. Finally, fund the trust fund by transferring your chosen possessions. Keep records of these transactions for openness and future reference. With these actions, you'll be on your means to appreciating improved financial privacy and safety and security through your overseas trust fund.

Regularly Asked Concerns

Can I Establish an Offshore Trust Remotely?

Yes, you can establish an overseas trust fund from another location. Several jurisdictions allow on-line applications and appointments. Just ensure you study trusted companies and comprehend the lawful description demands to make the process smooth and protect.

What Are the Tax Obligation Ramifications of Offshore Trusts?

Offshore trust funds can have various tax obligation implications depending upon your residency and the count on's framework. You could face taxes on revenue generated, yet correct preparation could aid minimize responsibilities and optimize benefits. Always consult a tax obligation consultant.

Just How Are Offshore Counts On Controlled Globally?

Can I Adjustment the Trustee of My Offshore Count On?

Yes, you can alter the trustee of your offshore trust, but it normally requires following certain treatments laid out in the count on file. Ensure you comprehend any kind of legal ramifications before making that decision.

What Happens if I Transfer To An Additional Country?

If you relocate to another nation, your offshore trust fund's tax obligation implications might change. You'll require to evaluate regional laws and possibly seek advice from an expert to assure conformity and maximize your financial method efficiently.

Report this page